This tip sheet from Illinois Early Learning offers information and insights about why children express separation anxiety and how it is a typical developmental behavior. There are also helpful suggestions for how to ease anxiety during separations. This is a resource that is useful for both child care professionals and families. Illinois Early Learning is funded by the Illinois State Board of Education and offers many other tip sheets as well as a variety of resources for professionals and families.

Separation Anxiety and Children Tip Sheet

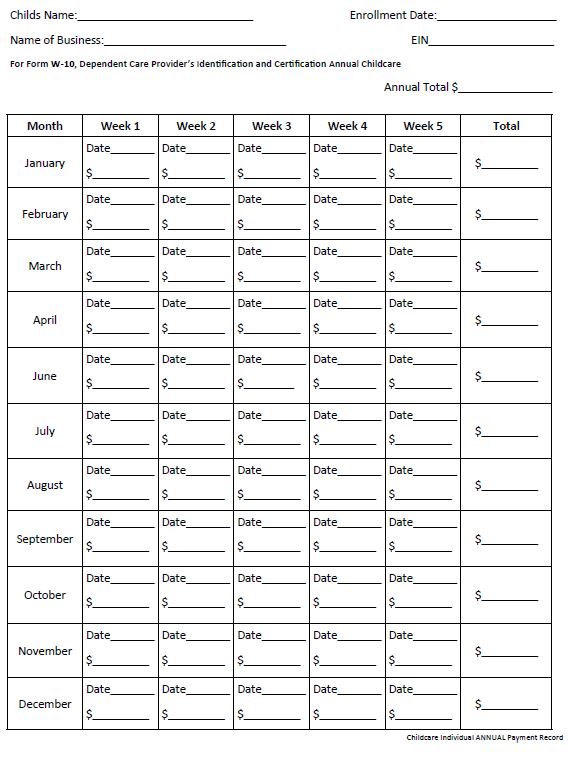

Tracking both spending and income is vital for any enterprise, especially for small businesses.

Tracking income requires logging payments per child/family as it helps ensure you are receiving funds, and has the added benefit of being a record of each payment. Accurate bookkeeping helps both you as well as the families complete their W-10 and taxes. Heather Mallett is a family childcare professional in Vincennes, Indiana. She is the Director and Owner of Happy Hearts Daycare and Preschool LLC, as such, Heather shares this Individual Annual Payment Record form to track payments and record totals for families. A few years ago, Heather came across this resource from a fellow childcare CEO based in another state and has used it ever since.

To use the form:

- Create one for each child/family at the start of the year

- Add the sheet to the child’s folder

- Enter in the payment every Friday, or whenever payment is due

- At the end of the month, tally the total

- At the end of the year, add the annual total and add your EIN

- Make a copy to share with families, and keep the original for your records

Heather also includes a note stating, if families request a second copy, it will cost $2.

Childcare Individual ANNUAL Payment Record

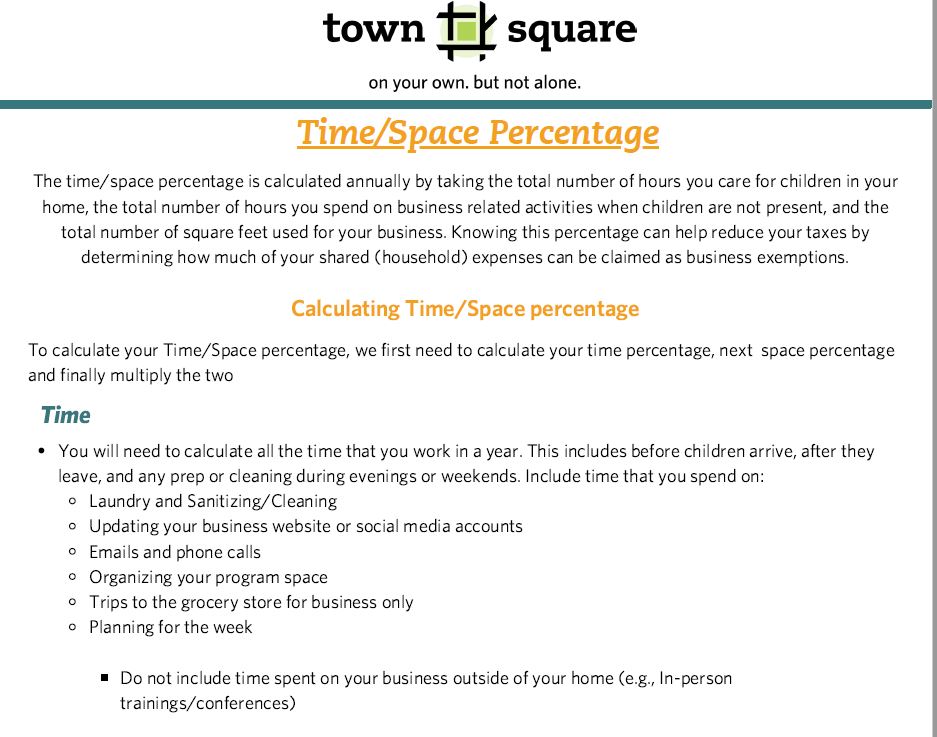

This Town Square created resources explores how to calculate your time and space percentage. Knowing this percentage can help reduce your taxes by determining how much of your shared (household) expenses can be claimed as business exemptions.

Town Square Research to Practice Statements offer information from theory and research with examples and suggestions for what it means in your work with children. This series of position statements includes topics such as the benefits of a home-like environment, the power of open-ended materials, and the benefits of incorporating the arts.

Town Square Research to Practice: The Power of Open-Ended Materials

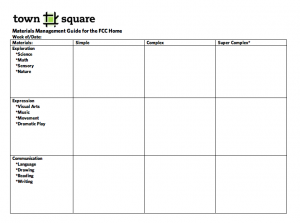

This guide can be a helpful tool when planning activities for multiple ages and that address different learning domains. You can learn more about learning domains and planning for multiple ages in the module: Selecting and Managing Materials that Support Learning Across Domains on the Professional Development Page in Town Square under the Town Square Modules tab.

Town Square Research to Practice Statements offer information from theory and research with examples and suggestions for what it means in your work with children. This series of position statements includes topics such as the benefits of a home-like environment, the power of open-ended materials, and the benefits of incorporating the arts.

Town Square Research to Practice: The Benefits of Incorporating the Arts

We asked family child care professionals what types of things they thought were most important to include in their contract and put together this tip sheet:

Top 5 Things to Include in Your Contract

Clearly defining your policies and following through on them is helpful for parents, for you as a professional, and also for maintaining the standards needed for licensing and high quality care.

Take some time to review and revise your program’s contract today!

Town Square Research to Practice Statements offer information from theory and research with examples and suggestions for what it means in your work with children. This series of position statements includes topics such as fostering self-regulation, the power of open-ended materials, and the benefits of incorporating the arts.

Town Square Research to Practice Statement: Parent Engagement

This guide offers much of the information you will need to get started in your family child care business in Illinois. There are sections about planning for your business, preparing your home, creating a contract, planning meals, and much more. This overview of the process is a helpful resource for understanding the steps in becoming a licensed family child care home.

The Illinois Department of Human Services offers an eligibility calculator that can help determine the amount of assistance for child care that a family may qualify for through the local child care resource and referral agency. You can access the CCAP eligibility calculator here.