One of the most significant challenges many providers face is ending the workday and giving yourself time off. Given your workplace is your home, it can feel like you are working all day and can’t take time off.

It is essential, especially during a stressful time, to take time for our mental health and be away from work. Having clear boundaries can help set the expectation of the importance of your time. Natalie Harrison, a family child care professional, and owner of Natty’s Treehouse Childcare in Muncie IN, shares the time boundaries she created for her business. She communicates these boundaries with families using her handbook; in doing so, families agree to her time limits.

Hours of operations – hours your business is open. Within that time, set time restrictions for how long a child/family can be in your care.

Natalie states in her handbook:

Hours of Operation:

Monday – Friday 6:00am-5:30pm

(No child should exceed 10 hours a day unless previously discussed with Natalie.)

Another time restriction can be time for families to communicate with you. While families can message/call you during opening hours, you can also set limits on after-hours messages; restricting messages can help you end the day.

Lastly, give yourself time to take time off, adding information on the vacation policy gives you time to close your business along with holidays you would like to celebrate or need a break.

Holidays

Natty’s Treehouse Childcare will be closed on all major holidays. Holiday dates and times are subject to change!

• New Year’s Day • Labor Day • Memorial Day • Thanksgiving • Friday after Thanksgiving •Christmas • 4th of July

Provider Vacation Policy

The provider will take up to two weeks of vacation each year. Formal notification will be provided to families 30-60 days before the vacation.

Setting clear time boundaries within your handbook can help communicate your business’s value and the need for you to take a rest.

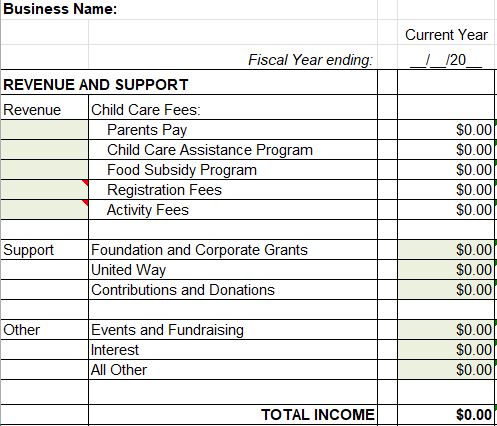

A vital part of owning a family child care business is having a budget; a budget provides essential information for operating, managing unexpected challenges, and turning a profit. Child Care Aware® of America created this Child Care Provider Budget Excel Worksheet to help you get started on creating a budget.

It’s impossible to predict the future, you never know when a natural disaster or emergency can occur. While you can’t prevent all emergencies, you can protect the children in your care, your family, and your business by having adequate insurance protection. This resource by Child Care Aware and Tom Copeland summarizes four types of insurance policies and why they are necessary to have.

How Insurance Protects You in an Emergency

An essential factor of operating a business out of your home is the time-space percentage helping determine the business portion of expenses used for business and personal purposes. The time/space percentage is calculated annually by taking the total number of hours you care for children in your home, the total number of hours you spend on business-related activities when children are not present, and the total number of square feet used for your business. This time tracker sheet will help you track your hours, ensuring that all your time (both with and without children) is included in the time-space calculation.

To use this time tracker, simply print out a copy for each month. Every day write down when the first child arrives when the last child leaves, calculating the time when children are present. Then write down the amount of time you worked on the business when children were not present. We have left some of the columns empty for you to add your own tasks/activities; remember, they must be activities for the business and inside your home. After adding the hours for each day, you will get a final number at the end of the month.

Tracking both spending and income is vital for any enterprise, especially for small businesses.

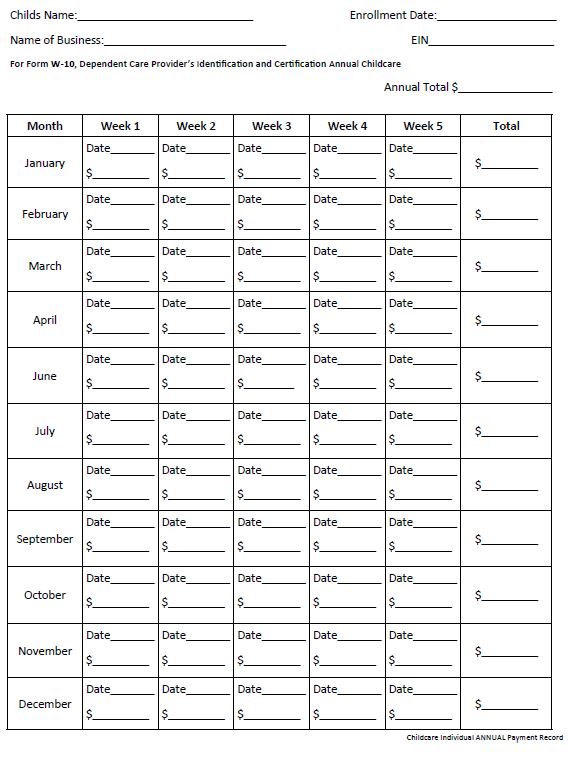

Tracking income requires logging payments per child/family as it helps ensure you are receiving funds, and has the added benefit of being a record of each payment. Accurate bookkeeping helps both you as well as the families complete their W-10 and taxes. Heather Mallett is a family childcare professional in Vincennes, Indiana. She is the Director and Owner of Happy Hearts Daycare and Preschool LLC, as such, Heather shares this Individual Annual Payment Record form to track payments and record totals for families. A few years ago, Heather came across this resource from a fellow childcare CEO based in another state and has used it ever since.

To use the form:

- Create one for each child/family at the start of the year

- Add the sheet to the child’s folder

- Enter in the payment every Friday, or whenever payment is due

- At the end of the month, tally the total

- At the end of the year, add the annual total and add your EIN

- Make a copy to share with families, and keep the original for your records

Heather also includes a note stating, if families request a second copy, it will cost $2.

Childcare Individual ANNUAL Payment Record

In our new Learn, Share, and Grow Series :Budgets and Policies for FCC

Laverne Head explains an essential part of any small business is the budget. In order to better get an understanding of tuition and fees, cost of operation, as well as profitability and sustainability, a budget is a must.

To get started on your own monthly budget, first choose either the Excel template to work digitally or the PDF template for a printable copy. The Excel version has been formatted to include formulas, thus all you do is input the number for each sheet, and it will calculate for you.

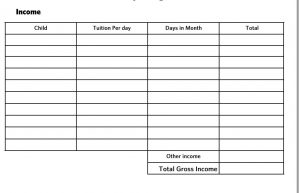

Next, calculate gross income. This is the money that comes into the business. You can figure this by listing the children in your program, the cost per day of tuition, and multiplying this by the number of days in the amount they attend the program. After tuition, add other income such as grants or food assistance.

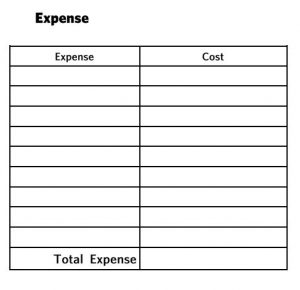

Second, calculate your expenses. This is all the cost associated with running your program. We have listed a few options within the templates but add anything you have purchased in that set month. Please make sure to include your salary here.

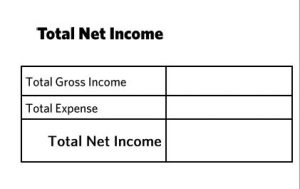

Lastly, calculate the net income. This is the amount that your business made in a month, and we drive this by subtracting expenses from gross income. From this you can see if you are profitable or if you need to reduce expenses or raise tuition to have a sustainable business.