While the informal setting of family child care can feel much warmer than a typical business, at the end of the day it is a source of income and a profession. As the owner of a family child care home, you’ll learn about marketing, advertising, accounting, and so much more.

With tax season in full force. We wanted to share this wonderful resource created by Home Grown Child Care with Civitas Strategies.

This tax workbook for Home-based Child Care providers, available in English & Spanish, was designed to simplify the process of completing 2022 taxes and alleviate some of the stress by providing step-by-step guidance.

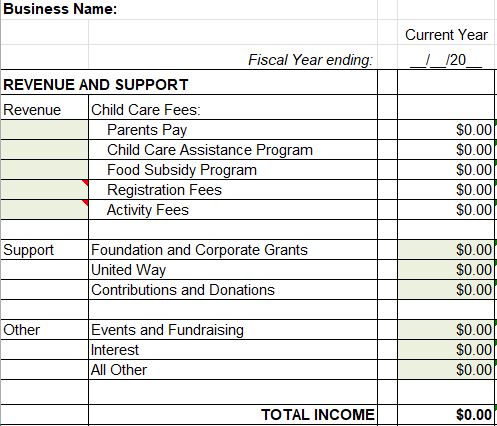

A vital part of owning a family child care business is having a budget; a budget provides essential information for operating, managing unexpected challenges, and turning a profit. Child Care Aware® of America created this Child Care Provider Budget Excel Worksheet to help you get started on creating a budget.