Home Grown, in collaboration with Civitas Strategies, will be hosting webinars for home-based child care providers on how to prepare for tax season. The webinars will review key topics including: identifying a tax preparer, understanding the documents you need for your taxes, and what to do to start getting ready for next year. There will be a session hosted in English and in Spanish. The English webinar will be held on Jan. 30 at 6 p.m. ET/ 3 p.m. PT.→ Register for English session here

Starting and growing your business will require advertising and marketing. This will look different for every provider, based on your location, target market, and what you offer to families.

This resource from First Children’s Finance offers family child care providers a full overview of creating a marketing plan customized for your program, including a sample budget.

Developing a Marketing Plan from First Children’s Finance. Before you get started, Town Square Resource Mission and Philosophy Statements might be helpful for their first steps of stating your mission and vision to find your market.

While the informal setting of family child care can feel much warmer than a typical business, at the end of the day it is a source of income and a profession. As the owner of a family child care home, you’ll learn about marketing, advertising, accounting, and so much more.

Family Child Care accountant and attorney Tom Copeland presented this session for family child care providers in April of 2022. He covers the difference between marketing and advertising, how to set and review your rates, what to do if a former client is creating negative publicity, and more!

As a family child care provider, making sure your business is financially sustainable has to be a priority.

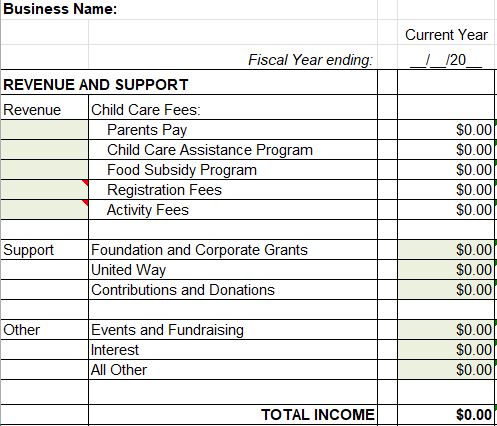

Taking the time to input your expenditures and income into a spreadsheet like this one will help to tell you when you’re on the right track or when you need to make changes to your business practices.

Keep these budget sheets as historical records; compare how you’re doing now to last month, six months ago, last year, and longer. Set a goal and work backwards: how much do you need to earn, and how can you get there?

Look ahead: what do you want to save for? More materials? Landscaping? A remodel? Retirement? Envision your five- and ten-year plans, and break that down into steps. How much would you need to put aside each month to make your dream a reality in five years?

Looking at finances can be intimidating, especially in a field that operates on such a small margin. But as the saying goes, “knowledge is power!” and the more you know about the financial health of your business, the better prepared you are for your future and for the children in your care.

“If we are not working on getting better then we are kinda stagnant and not growing … it is better to get in on front end of a program than the tail end so when a new program comes through we try to jump right on that and get our staff excited about it to be leaders.”

“We already knew we were operating at this higher level, why not have the validation from something like Paths to QUALITY, so that it was more than just us saying we are a strong program but having Paths to QUALITY backing us up as well.”

“I live in a low income area and I have had so many times since I started that I have had interviews set up with parents and I get no reason why they don’t show up. I wonder if some of them just figured out where I’m at and they won’t come. I’ve had someone say that on the phone one time – I know where that’s at. They don’t like the area…I thought it would give me some credibility.”

“I think we would like to get some recognition and also about what we do and maybe in return parents will be calling us and saying “oh, you are this level, we appreciate what you are doing so that is why I want my child to come to you.”

“For me, I joined PTQ because parents are looking at all types of daycares and if you want to stand out, you have to do something to stand out. Participating in whatever you can,

accreditation, whatever. It gives the parents a little something more to look at than just someone watching their kids. That this is what they do, this is their profession, they want to stand out with everything and with PTQ that helps us better our programs and our children so that it is beneficial to us and our programs.”

“…I like that you do get the benefits of moving up, leveling up and you do get that bonus where you get to go through the catalog because we run on peanuts trying to dish out for nutritional foods and things. We don’t have a lot of money to spend on the kids and that little incentive is good too. So it’s nice.”

Like the Early Childhood Nutrition Improvement Act, this proposal will benefit family child care providers who participate in the CACFP.

It will:

- Provide an additional 10 cent reimbursement for each meal and snack served in the CACFP

- Eliminate the tiering of family child care homes

- Allow family child care home providers to claim their own children’s meals for reimbursement

- Shift the calculation of family child care homes’ reimbursement from “food at home” to “food away from home” to align with centers

Click here to send a letter of support to your representative!

On October 26, the Early Childhood Nutrition Improvement Act (H.R.6067) was re-introduced in the House of Representatives by Congresswoman Suzanne Bonamici (D-OR) and Congressman Marc Molinaro (R-NY). This bipartisan legislation would:

- Allow providers who are open for more than 8 hours in a day to be reimbursed for an additional meal (up to 3 meals and 1 snack).

- Align the calculation of reimbursement rates for family child care homes with that of centers by shifting to “food away from home.”

- Allow annual eligibility for for-profit child care centers to streamline program operations.

This would make a huge difference in children’s nutrition and providers’ bottom lines.

Read More Here from the CACFP!

Click here to send a letter of support to your representative!

For more opportunities to advocate for yourself and your fellow providers, read about the Child Care Nutrition Enhancement Act here!

With tax season in full force. We wanted to share this wonderful resource created by Home Grown Child Care with Civitas Strategies.

This tax workbook for Home-based Child Care providers, available in English & Spanish, was designed to simplify the process of completing 2022 taxes and alleviate some of the stress by providing step-by-step guidance.

A vital part of owning a family child care business is having a budget; a budget provides essential information for operating, managing unexpected challenges, and turning a profit. Child Care Aware® of America created this Child Care Provider Budget Excel Worksheet to help you get started on creating a budget.